In the rapidly evolving world of cryptocurrency, decentralized finance (DeFi) has emerged as a revolutionary concept․ Among the myriad of DeFi projects, DeFiChain stands out as an innovative platform aimed at maximizing the benefits of blockchain technology․ This article explores how you can earn passive income through DeFiChain and why it’s a worthwhile consideration for crypto enthusiasts․

What is DeFiChain?

DeFiChain is a blockchain dedicated to providing decentralized financial services․ It operates on a unique proof-of-stake consensus mechanism, ensuring security and efficiency in transactions․ The platform aims to bring traditional financial products into the decentralized world, making them accessible to a broader audience․

Key Features of DeFiChain

- Decentralization: DeFiChain operates without a central authority, allowing users to maintain full control over their assets․

- Security: Utilizing blockchain technology, DeFiChain ensures secure transactions and data integrity․

- Interoperability: The platform can interact with various cryptocurrencies, enhancing its usability․

- Passive Income Opportunities: DeFiChain offers numerous ways to earn passive income, which we will explore further․

How to Earn Passive Income with DeFiChain

Earning passive income through DeFiChain can be achieved through several methods:

1․ Staking

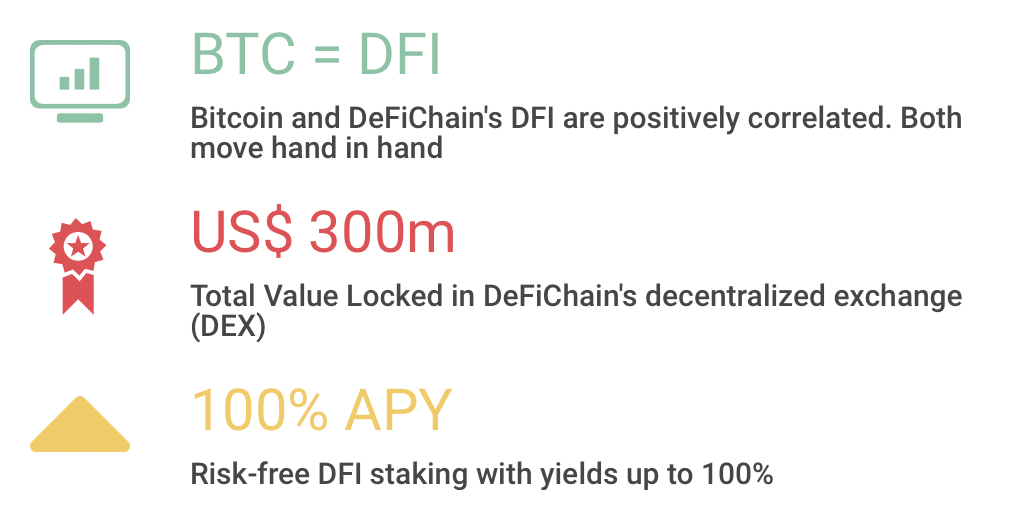

Staking is one of the most popular ways to earn passive income in the DeFi ecosystem․ In DeFiChain, users can stake their DFI tokens to support network operations․ Here’s how it works:

- Acquire DFI Tokens: Purchase DFI tokens from exchanges that support DeFiChain․

- Choose a Staking Pool: Select a staking pool to contribute your tokens․ Each pool may offer different rewards․

- Earn Rewards: As the network validates transactions, you earn rewards proportional to your stake․

2․ Liquidity Mining

Liquidity mining involves providing liquidity to the DeFiChain ecosystem․ By supplying your assets to liquidity pools, you can earn transaction fees and additional token rewards․ Here’s how to get started:

- Find a Liquidity Pool: DeFiChain offers various pools that require different assets․

- Deposit Assets: Deposit your assets into the chosen liquidity pool․

- Earn Passive Income: As users trade within the pool, you earn fees and incentives․

3․ Yield Farming

Yield farming is another method to earn passive income on DeFiChain․ It involves moving assets across different platforms to maximize returns․ Here’s a simplified process:

- Research Opportunities: Look for high-yield farming opportunities on DeFiChain․

- Invest and Move Assets: Invest in multiple platforms to capture the best yield rates․

- Reap Rewards: Collect your yields periodically and reinvest for compounding returns․

Benefits of Earning Passive Income on DeFiChain

There are numerous benefits to earning passive income through DeFiChain:

- High Returns: Compared to traditional savings accounts, the returns from DeFiChain can be significantly higher․

- Compound Growth: Reinvesting your earnings can lead to exponential growth over time․

- Flexibility: Users can choose how and when to invest, tailoring strategies to their financial goals․

- Community Engagement: Being a part of DeFiChain allows you to engage with a community of like-minded individuals․

DeFiChain presents a unique opportunity for individuals looking to earn passive income in the cryptocurrency space․ Through staking, liquidity mining, and yield farming, users can effectively utilize their assets to generate income․ As with any investment, it’s essential to conduct thorough research and understand the risks involved․ With the right strategies, DeFiChain can be a powerful tool for financial growth․

Whether you are a seasoned investor or new to the world of cryptocurrencies, DeFiChain offers a gateway to explore the exciting possibilities of decentralized finance․