The world of cryptocurrency is rapidly evolving, offering investors unprecedented opportunities to boost returns through innovative strategies․ One of the key players in this arena is dForce, a decentralized finance (DeFi) ecosystem that provides various financial services and products aimed at enhancing user returns․ In this article, we will explore how dForce operates and the smart strategies investors can employ to maximize their gains․

Understanding dForce

dForce is a comprehensive DeFi platform that encompasses several key components:

- dForce Lending: A lending protocol that allows users to borrow and lend various cryptocurrencies․

- dForce Stablecoin: A stablecoin designed to offer price stability and act as a means of exchange within the dForce ecosystem․

- dForce Swap: A decentralized exchange (DEX) for users to trade cryptocurrencies seamlessly․

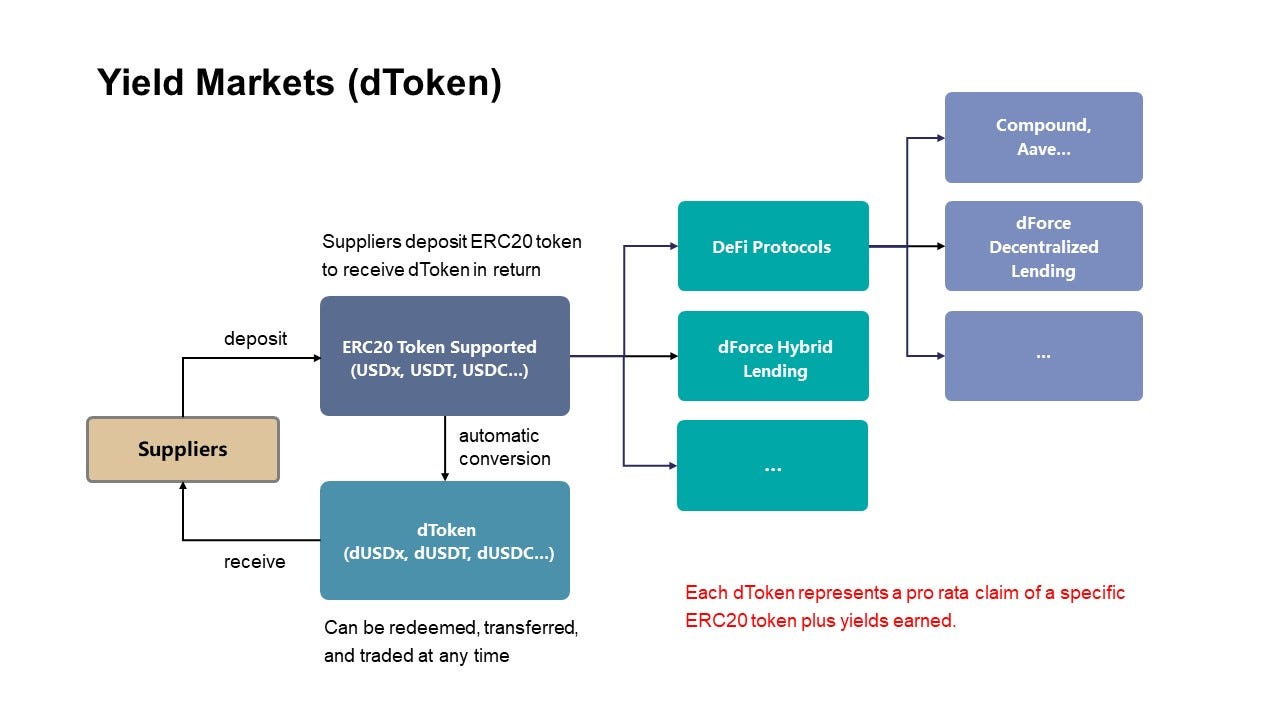

- dForce Yield Farming: A feature that enables users to earn rewards by providing liquidity to the dForce platform․

Key Features of dForce

To effectively boost returns, understanding the features of dForce is essential:

- Interoperability: dForce operates across multiple blockchains, allowing users to access a wide range of assets and liquidity․

- High Liquidity: The platform boasts high liquidity pools, which are crucial for efficient trading and lending․

- User-Friendly Interface: dForce provides an intuitive interface that makes it accessible for both beginners and experienced traders․

- Security: dForce employs robust security measures, including smart contract audits, to protect user assets․

Smart Strategies to Boost Returns with dForce

Now that we understand the dForce ecosystem, let’s delve into some smart strategies that investors can use to enhance their returns:

1․ Yield Farming

Yield farming is one of the most popular ways to earn passive income in the DeFi space․ By providing liquidity to dForce’s liquidity pools, users can earn interest and rewards in the form of governance tokens․ Here’s how to get started:

- Choose a liquidity pool that suits your risk tolerance․

- Deposit your assets into the pool․

- Monitor your returns and reinvest rewards to compound your earnings․

2․ Strategic Borrowing and Lending

dForce Lending allows users to take advantage of borrowing and lending strategies․ Investors can:

- Borrow against their crypto holdings to free up capital for other investments․

- Lend assets to earn interest, especially on stablecoins, which can provide predictable returns․

3․ Diversification

Diversifying your investments across different assets and pools within the dForce ecosystem can mitigate risks․ Consider:

- Investing in a mix of stablecoins and volatile assets․

- Participating in various yield farming pools to spread risk․

4․ Staying Informed

The cryptocurrency market is highly volatile and changes rapidly․ Staying informed about market trends, dForce updates, and broader economic indicators can provide critical insights for making informed decisions․ Follow:

- Official dForce announcements․

- Crypto news platforms․

- Social media channels of influencers in the DeFi space․

dForce offers a robust platform for investors looking to boost their returns through smart strategies in the DeFi space․ By leveraging yield farming, strategic borrowing and lending, diversification, and staying informed, users can create a well-rounded investment approach that maximizes potential gains․ As with all investments, it is crucial to conduct thorough research and assess your risk tolerance before diving into the world of cryptocurrency․

Embrace the opportunities that dForce presents and take your investment strategies to new heights!

5․ Utilizing dForce’s Stablecoin

One of the standout features of dForce is its stablecoin, which provides a safe harbor during market volatility․ Utilizing the dForce stablecoin can be an effective strategy to:

- Mitigate Risk: By holding stablecoins, investors can avoid the drastic price swings commonly associated with cryptocurrencies, preserving capital while still being part of the ecosystem․

- Facilitate Transactions: Use the stablecoin for trading or lending within the dForce platform, ensuring low volatility for transactions․

- Earn Interest: Many lending protocols offer attractive interest rates for stablecoin deposits, allowing users to earn a yield while maintaining stability․

6․ Engaging with Governance

As a decentralized platform, dForce allows token holders to participate in governance decisions․ Engaging with the governance process can serve several purposes:

- Influencing Development: By voting on proposals, users can influence the future direction of the platform, potentially leading to features that enhance user experience and returns․

- Staying Informed: Participating in governance discussions can keep users informed about upcoming changes, strategies, and innovations within the dForce ecosystem․

7․ Risk Management

While the potential for high returns in crypto is enticing, it’s crucial to implement effective risk management strategies․ Consider the following:

- Set Clear Investment Goals: Define what you want to achieve—be it short-term gains or long-term wealth accumulation․

- Use Stop-Loss Orders: If trading on a DEX or through leveraged positions, consider using stop-loss orders to limit potential losses․

- Regular Portfolio Rebalancing: Periodically assess your portfolio and make adjustments based on performance and market conditions․

8․ Community Engagement

One of the strengths of the dForce ecosystem is its community․ Engaging with other users can provide valuable insights and tips:

- Join Social Media Groups: Participate in forums, Telegram chats, or Discord servers dedicated to dForce and DeFi discussions․

- Attend Webinars and AMAs: Engaging in educational sessions hosted by the dForce team or community leaders can enhance your knowledge and investment strategy․

The dForce ecosystem represents a significant opportunity for investors looking to enhance their returns through strategic engagement with DeFi․ With its multifaceted offerings—ranging from lending and borrowing to yield farming and governance—dForce provides a comprehensive platform for individuals to optimize their investment strategies․

As the cryptocurrency landscape continues to evolve, staying agile and informed will be key to capitalizing on opportunities․ By employing smart strategies, diversifying investments, and actively participating in the community, investors can position themselves for success in the dynamic world of dForce and DeFi․

Embrace this exciting journey, and may your investments grow as you navigate the innovative pathways offered by dForce!

As you explore the dForce ecosystem, remember that education and community involvement will be your allies․ Engaging with seasoned investors and participating in discussions can provide insights that lead to informed decision-making․ Furthermore, continuously updating your knowledge about market trends and technological advancements will empower you to adapt your strategies accordingly․

Future Prospects of dForce

The future of dForce appears promising, with ongoing developments aimed at enhancing user experience and expanding the platform’s offerings․ As the DeFi sector matures, innovations in security, scalability, and user accessibility will likely play a pivotal role in differentiating platforms like dForce from competitors․

By keeping an eye on updates and participating in governance, you can position yourself at the forefront of these developments․ The evolving nature of blockchain technology means that what works today may evolve tomorrow, so agility is key․ Whether it’s new liquidity pools, additional features, or integrated services, staying engaged will ensure you are ready to capitalize on the next wave of opportunities․

Getting Started with dForce

If you’re ready to dive into the dForce ecosystem, here are some steps to get you started:

- Create a Wallet: Choose a compatible cryptocurrency wallet that supports Ethereum and DeFi protocols․

- Acquire Cryptocurrency: Purchase Ethereum or other cryptocurrencies from an exchange and transfer them to your wallet․

- Connect to dForce: Navigate to the dForce platform and connect your wallet․ Make sure to use a secure internet connection․

- Explore Opportunities: Familiarize yourself with the different features of dForce, including lending, borrowing, and yield farming․

- Start Small: Begin by investing a small amount to understand how the platform works, then gradually increase your investment as you gain confidence․

Final Thoughts

Engaging with dForce Crypto opens up a world of possibilities for savvy investors looking to enhance their returns․ The combination of innovative DeFi solutions, community engagement, and strategic investment can lead to significant financial growth․ As always, it’s essential to approach investments with caution and diligence․

With the right strategies, tools, and mindset, you can effectively navigate the dForce ecosystem and maximize your crypto investments․ The journey may be filled with challenges and learning opportunities, but the potential rewards are well worth the effort․ Embrace the future of finance with dForce, and watch your investment portfolio flourish!