In recent years, the cryptocurrency landscape has undergone significant transformations, offering traders numerous opportunities to capitalize on market fluctuations․ Among these opportunities, dYdX has emerged as a prominent player, providing a decentralized trading platform that empowers users to unlock their market potential․ This article delves into the features, benefits, and strategies associated with dYdX crypto trading, highlighting how it reshapes the trading experience․

What is dYdX?

dYdX is a decentralized exchange (DEX) built on the Ethereum blockchain, which allows users to trade cryptocurrencies with leverage․ It provides a platform for spot trading, margin trading, and derivatives trading, all without the need for a central authority․ By utilizing smart contracts, dYdX ensures transparency, security, and efficiency in trading operations․

Key Features of dYdX

- Decentralization: dYdX operates without a central authority, enabling peer-to-peer trading and eliminating counterparty risks․

- Leverage Trading: Users can trade with leverage, increasing their potential returns by borrowing funds to amplify their positions․

- Advanced Trading Options: The platform offers a variety of trading options, including perpetual contracts, which are popular among traders for hedging and speculation․

- Liquidity Pools: dYdX provides liquidity through its pools, allowing users to earn rewards by contributing their assets․

- User-Friendly Interface: The platform is designed for both novice and experienced traders, offering intuitive navigation and comprehensive tools․

Benefits of Using dYdX for Trading

1․ Access to Advanced Trading Features

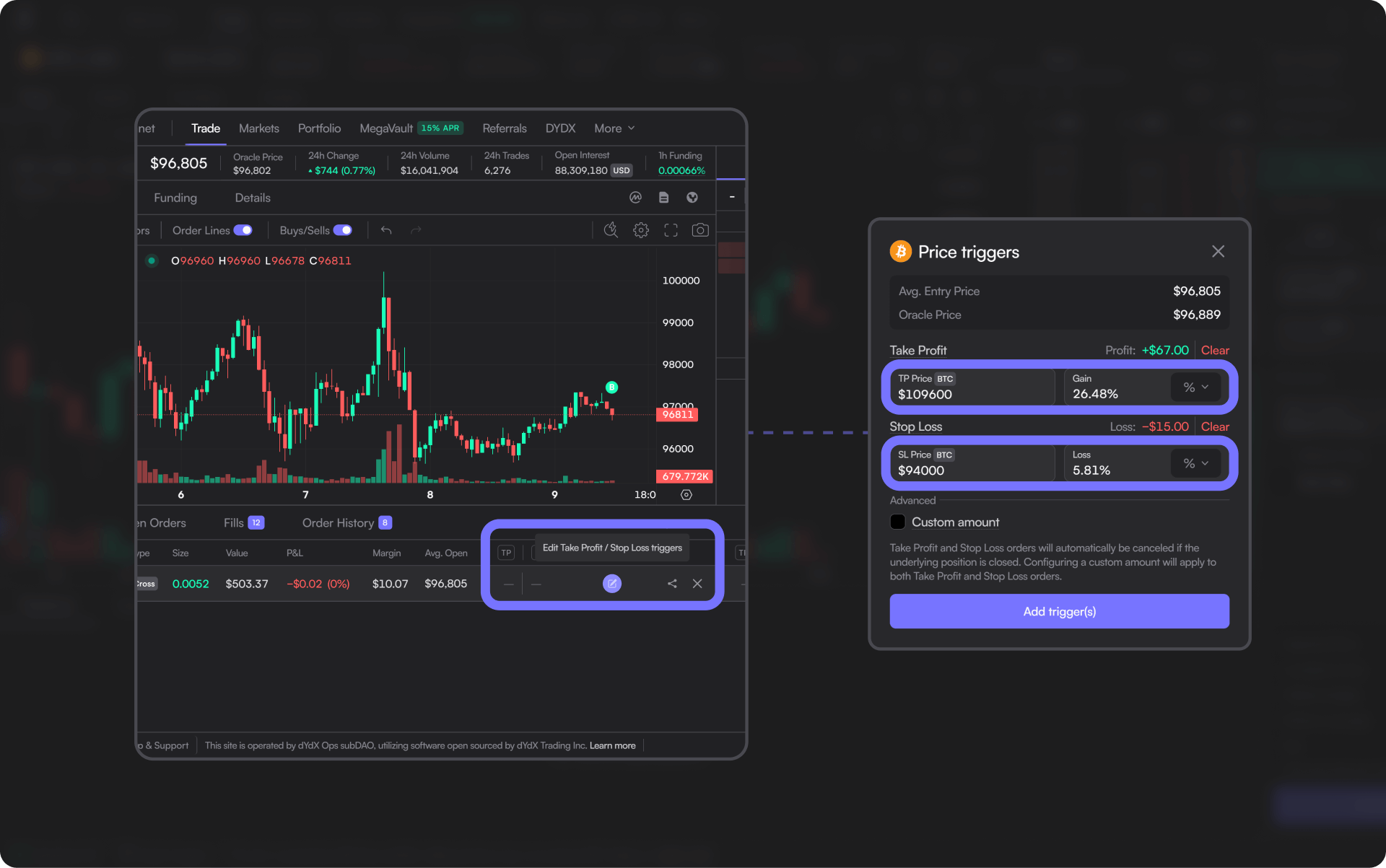

dYdX is not just a simple trading platform; it provides advanced features such as limit orders, stop-loss orders, and margin trading․ These tools help traders execute their strategies effectively and manage risks more efficiently․

2․ Enhanced Security and Transparency

Being a decentralized platform, dYdX ensures that users retain control over their funds․ Smart contracts govern the trading process, minimizing the risk of hacks and fraud that are often associated with centralized exchanges․

3․ Competitive Fees

dYdX offers competitive trading fees compared to traditional exchanges․ Users benefit from lower transaction costs, especially when trading in high volumes, making it an attractive option for frequent traders․

4․ Diverse Asset Selection

The platform supports a wide range of cryptocurrencies, enabling traders to diversify their portfolios and explore various market opportunities without switching between multiple exchanges․

Getting Started with dYdX Trading

Step 1: Create an Account

To begin trading on dYdX, users need to create an account․ This involves connecting a digital wallet, such as MetaMask, and ensuring that it contains the necessary cryptocurrencies for trading․

Step 2: Fund Your Account

After setting up the wallet, users can deposit funds into their dYdX account․ This can be done by transferring cryptocurrencies from other wallets or exchanges․

Step 3: Choose a Trading Pair

Once the account is funded, traders can select the desired trading pair․ dYdX offers various options, including BTC/ETH, ETH/USDC, and more․

Step 4: Execute Trades

Traders can place market orders, limit orders, or leverage trades based on their strategies․ dYdX provides real-time charts, order books, and analytics to assist in decision-making․

Strategies for Successful Trading on dYdX

1․ Risk Management

Successful trading involves managing risks effectively․ Traders should determine their risk tolerance and set stop-loss orders to limit potential losses․ Diversifying their portfolio and avoiding over-leverage can also mitigate risks․

2․ Technical Analysis

Utilizing technical analysis tools can enhance trading accuracy․ Traders should analyze price charts, volume trends, and indicators to identify potential entry and exit points․

3․ Stay Informed

Keeping abreast of market news and developments is crucial for making informed trading decisions․ Following reputable crypto news sources and engaging with the community can provide valuable insights․

4․ Practice with Small Amounts

For beginners, it is advisable to start trading with smaller amounts to gain experience without risking significant capital․ As confidence and skills develop, traders can gradually increase their investment․

dYdX crypto trading presents a unique opportunity for traders looking to unlock their market potential in a decentralized environment․ With its advanced features, security measures, and user-friendly interface, dYdX caters to both novice and experienced traders alike․ By understanding the platform’s functionalities and implementing effective trading strategies, users can navigate the cryptocurrency market with confidence and success․ As the crypto landscape continues to evolve, platforms like dYdX are paving the way for innovative trading experiences that empower users to take control of their financial futures․